Discover Profitable Opportunities: Top Commercial Characteristics to buy

In the ever-evolving landscape of business property, determining profitable chances requires an eager understanding of market dynamics and home capacity. From high-demand retail areas in dynamic city centers to the burgeoning commercial sector fueled by e-commerce, different sections use distinctive benefits. In addition, arising markets existing distinct leads for workplace buildings and multi-family systems that promise constant returns. As we check out these alternatives, it ends up being evident that particular financial investment approaches might redefine the criteria of success in your profile. What factors should one take into consideration to take full advantage of these possibilities efficiently?

Retail Spaces in High-Demand Locations

In today's affordable market, retail areas in high-demand locations are increasingly becoming a focal point for financiers and company owner alike. These places, characterized by high foot web traffic and solid demographic charm, present special opportunities for growth and productivity. The significance of place can not be overstated, as proximity to services, household advancements, and transport centers frequently influences customer behavior.

Financiers are particularly attracted to retail spaces in city facilities, where a varied consumer base is consistently seeking ease and availability. High-demand locations often flaunt well established brands and prospering regional organizations, producing a lively community that brings in more investment. The increase of ecommerce has actually triggered typical merchants to adjust, looking for physical spaces that boost the buying experience and strengthen brand visibility.

Industrial Residence With Development Potential

Among the evolving landscape of business actual estate, commercial residential properties with development possibility are becoming a compelling financial investment chance. The rise in ecommerce and the need for effective supply chain options have accelerated demand for storehouses, circulation centers, and making facilities. Capitalists are significantly recognizing the worth of these properties, specifically in tactically situated locations that provide simple accessibility to transport networks.

One essential variable driving development in industrial buildings is the shift in the direction of automation and progressed manufacturing innovations. Facilities that can accommodate modern-day tools and logistics demands are specifically attractive, as they make it possible for organizations to optimize procedures and reduce costs (commercial property for sale in melbourne australia). In addition, the surge of sustainability efforts is triggering business to seek eco pleasant and energy-efficient industrial spaces

Areas experiencing populace development and infrastructure development are prime targets for financial investment. Industrial residential properties in these locations not only gain from boosting need however also stand to value substantially in worth over time. As businesses continue to adjust to altering market problems, investing in commercial residential properties with growth potential deals a mix of stability and chance for smart investors looking to diversify their profiles.

Office Complex in Emerging Markets

As companies significantly look for economical options and versatile workplace, office structures in emerging markets are gaining interest from financiers. These areas, characterized by fast urbanization and an expanding middle course, existing distinct chances for those wanting to profit from the advancing landscape of commercial realty.

Arising markets usually feature reduced procurement expenses compared to developed counterparts, making them attractive for financiers looking for significant returns. The demand for contemporary workplace is sustained by a growing business ecological community and the increase of international firms seeking to develop a visibility in these dynamic economic situations. Furthermore, government motivations and infrastructure renovations even more enhance the appeal of these markets.

The adaptability of office formats, consisting of co-working rooms and crossbreed designs, aligns with existing service trends, permitting capitalists to accommodate diverse renter needs. The possibility for long-lasting recognition is significant as these markets continue to grow and mature.

Capitalists thinking about office complex in arising markets must carry out complete due diligence, concentrating on neighborhood economic indicators and governing atmospheres. By strategically browsing these aspects, they can unlock successful possibilities in my explanation a swiftly transforming industrial landscape.

Multi-Family Units for Steady Revenue

Buying multi-family devices uses a trusted opportunity for generating steady income, appealing to both skilled capitalists and beginners in the industrial realty market. Multi-family buildings, such as apartment or condo complexes and duplexes, provide various advantages over single-family leasings, consisting of decreased job dangers and economies of range.

One of the vital advantages of multi-family financial investments is the capacity to branch out earnings streams. With multiple lessees, homeowner can mitigate the monetary impact of vacancies, ensuring a more secure capital. Additionally, multi-family systems are usually situated in high-demand urban areas, where rental demand stays robust, boosting the capacity for lasting gratitude.

Additionally, multi-family residential or commercial properties typically require reduced upkeep prices each compared to single-family homes, permitting much more effective administration. Capitalists can also exploit on value-add opportunities by upgrading devices, which can cause raised rental fees and overall residential property value.

Special Investment Opportunities to Take Into Consideration

Exploring one-of-a-kind financial investment opportunities can considerably enhance your portfolio and give avenues for growth beyond typical property choices. One notable option is buying flexible reuse properties-- structures repurposed for new usages, such as transforming old manufacturing facilities right into loft-style apartments or offices. These residential or commercial properties often come with tax motivations and can bring in renters looking for look at this now special living or working environments.

One more fascinating method is purchasing co-working areas, which have acquired popularity because of the increase of remote job. By acquiring or renting commercial residential or commercial properties to produce collective work areas, capitalists can take advantage of the growing demand for versatile workplace services.

Additionally, take into consideration particular niche markets like self-storage centers, which are relatively recession-resistant and can produce steady returns. As urban space reduce, the demand for storage space options proceeds to climb.

Lastly, fractional ownership in commercial homes enables financiers to pool resources, hence reducing private financial risk while accessing high-value properties. This version democratizes commercial actual estate investments, making them accessible to a more comprehensive series of capitalists. By branching out right into these special chances, you can enhance your profile's resilience and potential for development.

Final Thought

In summary, the existing landscape of business property offers successful and diverse possibilities throughout different residential or commercial property kinds. High-demand retail spaces, industrial residential properties positioned for development, arising market office complex, and multi-family devices each deal distinct benefits for investors. Furthermore, cutting-edge financial investments such as adaptive reuse homes and co-working rooms add to profile diversification and risk reduction. By tactically targeting these sectors, capitalists can profit from prevailing market patterns and enhance general returns.

In the ever-evolving landscape of commercial real estate, identifying profitable opportunities requires a keen understanding of market characteristics and home possibility.Among the evolving landscape of commercial actual estate, industrial homes with growth possibility are emerging as an engaging investment chance. As services continue to adjust to transforming market conditions, investing in commercial residential or commercial properties with development prospective offers a blend of security and opportunity for savvy capitalists looking to diversify their portfolios.

Finally, fractional possession in industrial residential or commercial properties permits financiers to merge sources, hence decreasing private monetary risk while accessing high-value buildings. High-demand retail spaces, commercial buildings poised for development, emerging internet market office structures, and multi-family systems each deal special benefits for financiers.

Ross Bagley Then & Now!

Ross Bagley Then & Now! Yasmine Bleeth Then & Now!

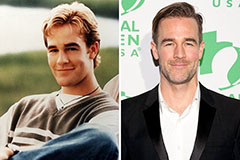

Yasmine Bleeth Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!